PT Astra International Tbk. (ASII)

BETA= 1.447045614

WACC= 27.87%

Equity value (in IDR ,000,000,000)= 46,635.60

Value per share (in IDR) = 11,519.64

last trade

ASII= 15,400.00

JKSE= 1,717.73

INDO-17= 6.248

notes

- This service has been inactive since 2010 as my new role in TM1 consulting.

- Please disregard any commercial offers as this website has been archived and transformed into a blog rather than a commercial website.

- Please contact me for more info in BI and Financial Modelling consultancy.

Initial Capital Investment

As every business must start with an initial capital investment, KBF builds its plant and office with own equity and bank loans. KBF's equity and loan from bank may first deposit or transfer to savings before being spent for capital expenditures.

To do this, the simple way is to create journal directly:

go to command centre > accounts list

There some new accounts we want to create here:

1. KBF equity

2. KiwiBank Term Loans

3. KiwiBank Savings

For KBF equity, go to equity > press new

Fill in the form something like this:

Same process for KiwiBank Term Loans with account type: liability and KiwiBank Savings with account type: asset.

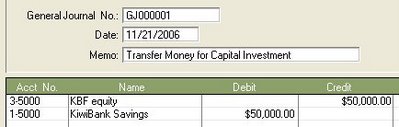

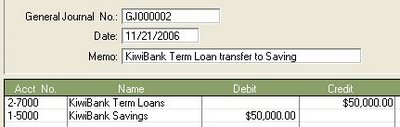

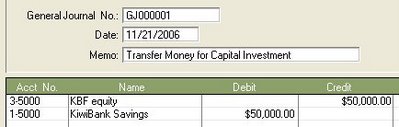

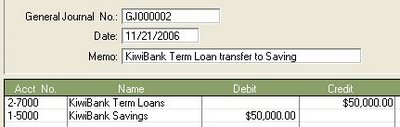

Then, just record the journals as KBF's equity and loan from bank being transfered or deposited to savings. Go to record journal entry.

Equity

Loan

From here, KBF can establish the biofuel plant and buying office equipment and vehicles. Go to purchase > enter purchases. Please use GST tax code - Standard (S) with 12.5% GST. Then pay or close all open bill with electronic clearing account.

Finally, by checking the account list (go to accounts > accounst list), it can be found the balance sheet position something like this.

How about the inventory and production? Does KBF need more funding to start production? Stay tuned.

To do this, the simple way is to create journal directly:

go to command centre > accounts list

There some new accounts we want to create here:

1. KBF equity

2. KiwiBank Term Loans

3. KiwiBank Savings

For KBF equity, go to equity > press new

Fill in the form something like this:

Same process for KiwiBank Term Loans with account type: liability and KiwiBank Savings with account type: asset.

Then, just record the journals as KBF's equity and loan from bank being transfered or deposited to savings. Go to record journal entry.

Equity

Loan

From here, KBF can establish the biofuel plant and buying office equipment and vehicles. Go to purchase > enter purchases. Please use GST tax code - Standard (S) with 12.5% GST. Then pay or close all open bill with electronic clearing account.

Finally, by checking the account list (go to accounts > accounst list), it can be found the balance sheet position something like this.

How about the inventory and production? Does KBF need more funding to start production? Stay tuned.

It's better to build your own accounts

Start with creating a new company file:

Then, follow the instructions until the accounts list menu. In this menu, it is recommended to build your own accounts list as you might need some flexible adjustments when recoding journals.

Then, follow the instructions until the accounts list menu. In this menu, it is recommended to build your own accounts list as you might need some flexible adjustments when recoding journals.

Kiwi Biofuel Ltd

Kiwi Biofuel (KBF) Ltd is a fictional manufacturing company used in this MYOB simulation. KBF produces liquid biofuel from kiwi fruits. With $100,000 assets raised from $50,000 equity and $50 loan, KBF's production capacity is 1,000 litre per day or 300,000 litre per year. It employs 2 labours, 1 engineer and 1 office assistant.

To produce 100 litre, it needs:

5 tray kiwi fruits @$6.00 per tray

2 hours labours @$12.50 per hour

50 kWh electricity @$0.10 per kWh

Total = $60 per 100 litre

Selling price = $1.00 per litre

One year budget:

To produce 100 litre, it needs:

5 tray kiwi fruits @$6.00 per tray

2 hours labours @$12.50 per hour

50 kWh electricity @$0.10 per kWh

Total = $60 per 100 litre

Selling price = $1.00 per litre

One year budget:

- Sales = $300,000

- Cost of sales = $180,000

- Advertising = $10,000

- Salaries = $60,000

- Office = $10,000

- Maintenance = $ 10,000

- Other expenses = $10,000

- Operating profit = $20,000

- Tax = $6,600

- OPAT = $13,400

- ROA = 13.40%

- ROE = 26.80%

The Market Deviates?

There are some reasons why the market price deviates from the valuation of Astra International. If the valuation is correct, the market is currently trying to drive the price up until some level to conduct short selling as the future expectation is long (buy) when the price is low as of the valuation. Otherwise, the valuation is wrong.

AstraWatch: Week - 6 Nov 06

PT. Astra International Tbk. (ASII)

BETA= 1.446220312

WACC= 27.63%

Equity value (in IDR ,000,000,000) = 48,100.64

Value per share (in IDR) = 11,881.53

last trade

ASII= 14,500.00

JKSE = 1,664.84

INDO-17= 6.207%

BETA= 1.446220312

WACC= 27.63%

Equity value (in IDR ,000,000,000) = 48,100.64

Value per share (in IDR) = 11,881.53

last trade

ASII= 14,500.00

JKSE = 1,664.84

INDO-17= 6.207%

AstraWatch: Week - 30 Oct 06

PT. Astra International Tbk. (ASII)

BETA= 1.447344401

WACC= 27.28%

Equity value (in IDR ,000,000,000)= 50,441.23

Value per share (in IDR)= 12,459.68

last trade

ASII= 13,950.00

JKSE= 1,612.95

INDO-17= 6.413%

BETA= 1.447344401

WACC= 27.28%

Equity value (in IDR ,000,000,000)= 50,441.23

Value per share (in IDR)= 12,459.68

last trade

ASII= 13,950.00

JKSE= 1,612.95

INDO-17= 6.413%

AstraWatch: Week - 16 Oct 06

PT. Astra International Tbk. (ASII)

BETA= 1.447796665

WACC= 27.02%

Equity value (in IDR ,000,000,000)= 52,269.56

Value per share (in IDR) = 12,911.31

last trade

ASII= 13,500.00

JKSE= 1,572.85

INDO-17= 6.47%

BETA= 1.447796665

WACC= 27.02%

Equity value (in IDR ,000,000,000)= 52,269.56

Value per share (in IDR) = 12,911.31

last trade

ASII= 13,500.00

JKSE= 1,572.85

INDO-17= 6.47%