To do this, the simple way is to create journal directly:

go to command centre > accounts list

There some new accounts we want to create here:

1. KBF equity

2. KiwiBank Term Loans

3. KiwiBank Savings

For KBF equity, go to equity > press new

Fill in the form something like this:

Same process for KiwiBank Term Loans with account type: liability and KiwiBank Savings with account type: asset.

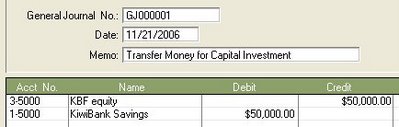

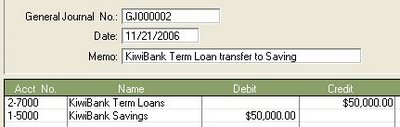

Then, just record the journals as KBF's equity and loan from bank being transfered or deposited to savings. Go to record journal entry.

Equity

Loan

From here, KBF can establish the biofuel plant and buying office equipment and vehicles. Go to purchase > enter purchases. Please use GST tax code - Standard (S) with 12.5% GST. Then pay or close all open bill with electronic clearing account.

Finally, by checking the account list (go to accounts > accounst list), it can be found the balance sheet position something like this.

How about the inventory and production? Does KBF need more funding to start production? Stay tuned.

0 comments:

Post a Comment